The Investor Diary Entry #46: August 1, 2023

I finished the FOREX Trading training course a couple of weeks ago, but all investing and trading activities were paused due to some harsh circumstances. This is what we mean when we say in life coaching “life happens.” Today is the first day that I resume my daily work routine.

The first thing that I needed to be comfortable with in Forex Trading was setting up my charts in a way that would make sense to me. In a previous diary entry, I explained how I use color coding to identify support and resistance from different time frames.

The next thing to be comfortable with is not getting my trades to be profitable, but to make sure that I am following my Forex trading Risk Reward Ratio Formula. Of course, getting profitable trades along the way is not bad at all.

My Trading Exposure Rules

Before we get into these rules, I need to point out that I am now using a demo account. I will not move into a trading account until I achieve my demo account objective.

On the exposure part, I use between 2% – 3% risk on each trade. Meaning that I only risk 2% of my account size on each trade. Even though my rule is between 2 – 3%, I am always around 2% and I try not to get near the 3%. This has to do with the next exposure rule.

All open trades should have a total exposure of 5%-6%. Meaning, that the maximum number of positions opened should not exceed three positions (2% exposure x 3 trades= 6% total exposure).

It is this rule that I am struggling with. I cannot seem to be able to limit myself to this rule. Things get complicated when I have opened positions as well as pending orders.

Another challenge with implementing the exposure per trade is when I have opened positions, and I need to decide on my exposure for the following trade. The question here would be which account size should I use to calculate my exposure?

Pending orders’ exposure is calculated based on the account size available at the time of setting them up. If a couple of open trades close in the red, then all pending orders exposure increases. This is acceptable as this won’t get them away from the range of 2 – 3%, but the total exposure of opened trades would be affected considerably.

Risk Reward Ratio Formula

The rule that I know is that each trade should have a risk-reward ratio (RRR) of 1:2. This means that amount each trade intends to profit should be at least double the amount that the trade is risking.

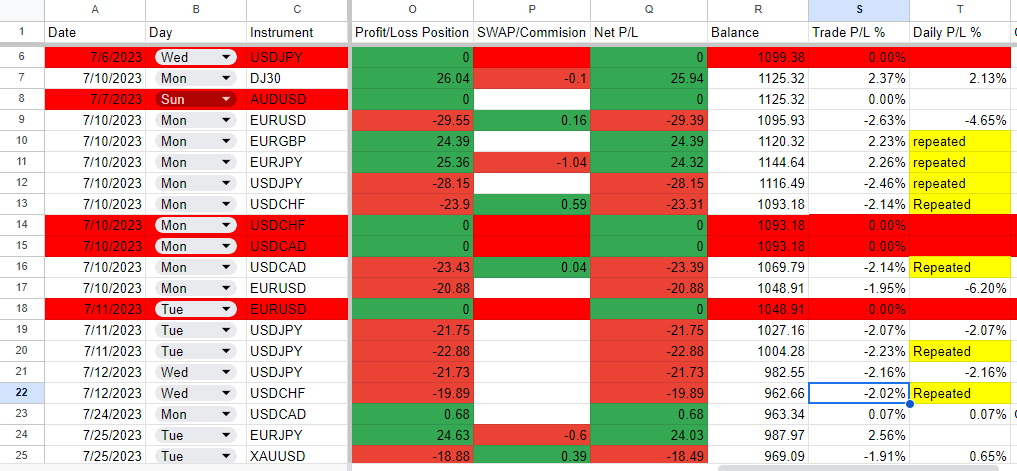

I started logging my demo account trades on July 3rd, 2023. If I have applied the above rule I would be in the green.t Unfortunately, I am not in the green now. I am in the red. The reason why I am in the red is that my RRR was around 1:1. Meaning that the amount of money that I am risking in each trade equals the amount of money I intend to profit from that same trade.

An RRR of 1:1 means that my total winning trades should be higher than my losing trades. In Forex, that is not easy to achieve. Therefore, since yesterday I found a comfortable way of making sure that my RRR is at least 1:2.

I would first decide on my entry price and take-profit (TP) price point. Then I would calculate the number of pips between my entry point and TP. Take that result and divided by 2. The result is the number of pips to my stop-loss (SL) price point. I realized that in some cases I don’t need to put my SL that far, which enhances my RRR.

Why Use RRR?

RRR is the way that will ensure that a trader stays in the game for the longest time possible even after a long streak of losses. Another benefit is that it reduces the number of emotions involved in each trade.

I am not new to Forex trading. I started trading in 2004. My last live account and last live trading was in 2012. I decided that I am not a good trader and that I use my emotions a lot without any clear methodology. For those reasons, I decided to stop trading live, but I always had my demo account for trials and experimentation. Even with that, nothing worked.

When I took the training course, I realized that what I was doing during my past trading years was not wrong. The trading ideas were not wrong, but I never had any rules regarding exposure and RRR. The absence of those formulas made my account liquidate easily, and I would find myself out of the game very quickly.

I would have a very good winning ratio, in many cases, my wins would be more than my losses, but a couple of losing trades that are not well managed are capable of destroying all the build-up, and after that, all the trades are based on emotions.

Only in this training, I realized that there was something called gambling trading. This is what I was doing all those years.

My Demo Account Objective

The demo account size that I am using is USD 10,000, but I am dealing with it as if I have USD1000. I am doing this for my training.

Once I achieve my demo account objective using my Forex trading risk reward ratio and my exposure rules, I will open a live account with USD1000.

The objective that I set for myself during the phase of trading on a demo account is to turn a USD1000 account into a USD2000 account size. If I achieve this objective using the above rules, I would know that I am ready to open a live account with a strategy that I am comfortable with.

Conclusion

Yesterday I opened three Trades XAUUSD, USDJPY, and GBPUSD. XAUUSD closed negative while the other two are still open till the time of writing these words.

Today I opened another three trades; USDCAD, EURJPY, and GBPJPY. USDCAD closed negative while the other two are still open.

I have four open trades with only the GBPUSD in the green.

Tomorrow, I have some family commitments. Let us see how will that play out with my work routine. Today’s work distribution and routine were great. I was able to study my charts until mid-day. Took a little break, and started writing my diary entry.

I still have time to publish it and maybe some reading. This is a very relaxing and productive work routine.

Tuesday 1 August 2023

About The Author

I started to look into individual stocks in January 2022. I created this diary initially for myself to track my investing progress, and second, as a place where I can share my ideas publicly hoping that others will share their ideas and learn from each other, and lastly, as an online business where some links that I share are affiliate links, and if anybody bought anything by clicking those links I will get a commission based on that successful sale, which of course will not affect the price that you are buying the product or service at.

For more detailed information on my affiliate disclosure please refer to the Full Affiliate Disclosure page, and if you are interested in building your own online business you can check this post here.

Furthermore, this site is in no way or form giving any financial or investment advice, nor it is encouraging or discouraging people to buy or sell any financial instrument. This is a personal diary in which I track my progress and share it for informational, educational, and entertainment purposes.