The Investor Diary Entry #61: September 15, 2024

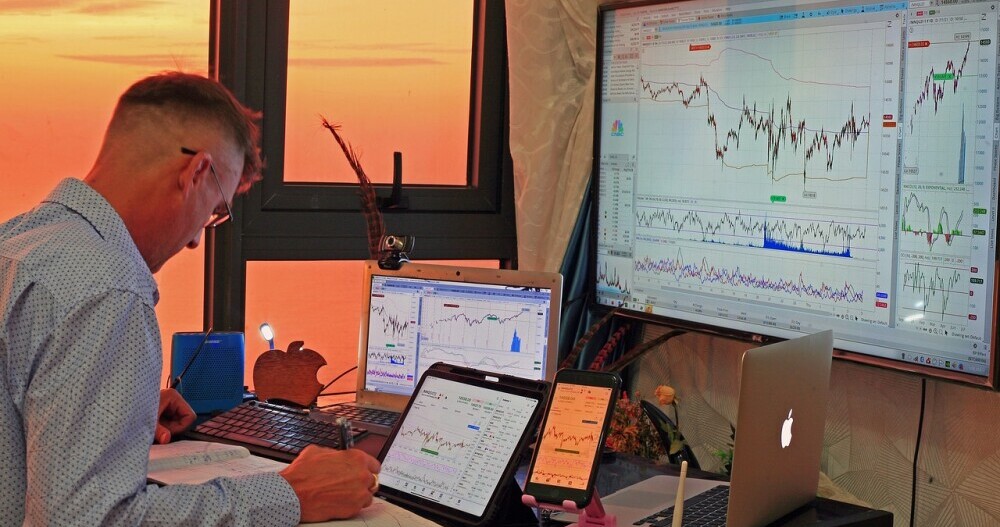

In trading, controlling drawdown while chasing potential returns is a big deal. I’ve been around the block a few times, and it took me years to realize that I needed a consistent methodology if I wanted to succeed in trading.

Until now, and after all those years, I cannot say that I succeeded, as I have been doing the same as many, moving from one method to the other and following every method that I heard of.

Finally, I realized that I needed to create my own methodology. In my last blog post, I talked about the last Forex Training that I attended, and how from that training I started gathering the tools of the methodology that fit my style.

Over the past few weeks since my last blog post, I’ve tuned my trading methodology and learned that the trick was to focus right on the sweet spots—those crucial chart points with the least drawdown probability. Let’s walk through this updated method together.

Understanding the balance between minimizing losses and maximizing gains is key. It’s like walking a tightrope, but with the right tools, you can make it across with confidence. In this post, I’ll share how I’ve used specific indicators and techniques to pull this off.

So, what’s on the menu today? We’ll dig into the free TradingView indicators I rely on to keep my trades in check. I will go through identifying key positions using these indicators. Get ready to dive into Volume Zones, Supply and Demand Zones, Support and Resistance Areas, Fibonacci Levels, and Pivot Points and EMAs.

This is no secret sauce recipe. It’s about using well-known, reliable indicators effectively. By the end of this read, you are going to see my action plan sketch that I use to optimize my trading strategy and sidestep those nasty drawdowns.

Essential TradingView Indicators for Low Drawdown Trades

Volume Zone with Climatic Volume: I Start by pinpointing the recent volume zone, crucial to grasping market sentiment and potential hotspots of trading activity. The free “Climatic Volume” indicator on TradingView spotlights where significant action has occurred. This isn’t just about numbers; it reveals the story behind price movements and likely areas of interest.

Supply and Demand Zones: Next, hunt for the Supply and Demand Zones. These zones highlight where strong buyer or seller interest has previously appeared. Recognizing these zones helps forecast where price movements might face resistance or support, making it easier to predict future trends. I used to use an indicator for that, then I decided to spot what I can myself. I couldn’t find an indicator that would be nice and neat on the chart.

Support and Resistance Areas: Once you’ve got your supply and demand zones, zero in on the most relevant Support and Resistance Areas. Plotting these around the current price gives you a clear idea of prominent levels that could impact future price movements. Keep it clean and simple to avoid overcomplicating your chart. I try to find the ones that are around the current price level only.

Fibonacci Retracement Levels: Now, whip out the Fibonacci Retracement tool to mark levels where price might pull back before continuing its trend. These levels aid in spotting potential reversal or consolidation points. It’s a blend of math and trading psychology that can be quite revealing. I personally concentrate on 0.382, 0.5 and 0.618.

Pivot Points and EMAs: Round things off by adding Pivot Points and Exponential Moving Averages (EMAs) to your chart. Pivot Points give you vital price levels where the market could see significant action, while EMAs—specifically the 20, 50, 100, and 200 periods—help determine trend direction and possible support or resistance areas. For the Pivot points, I only use the last day’s and I keep it on Auto so as to change if I change the timeframe.

Advanced Techniques and Multi-Time Frame Analysis

ABC Formation for trend stops and reversals: To nail down where the trend might take a breather and then continue its path, the ABC pattern is your best friend. This tool on TradingView helps in spotting those golden moments when a trend is likely to reverse or pause before resuming. The Fibonacci Extention Tool is the one I learned to use to spot the “C” point. It is at level “1.”

RSI for momentum and divergence: The Relative Strength Index (RSI) is the go-to for gauging market momentum and spotting divergences. Keeping an eye on whether the RSI is above or below 50 guides me on the prevailing trend. Plus, RSI divergences serve as early warning signs for potential reversals or continuations.

Optional MACD for confirming signals: The Moving Average Convergence Divergence (MACD) isn’t always necessary, but it’s a handy extra check. It offers insights into the trend strength and direction, adding another layer of confirmation. I heard a lot about the importance of MACD, but to tell you the truth, until now I couldn’t see the extra value, but I keep an I on it to see how it confirms with the RSI especially when it comes to divergences.

Daily Chart Magic: I start on a daily chart, combining these indicators helps me map out Buy and Sell zones clearly. This bird’s-eye view can highlight significant entry points, making the decision process more informed. Occasionally, I do spot some exact entry points, and I take them.

Zooming in with 4-Hour and 1-Hour Charts: I check the 4-hour and 1-hour charts. This close-up analysis sharpens my focus, ensuring I pinpoint exact entry opportunities that don’t require far Stop Loss levels.

Practical Tips for Maximizing TradingView’s Free Features

Managing indicators within TradingView’s free version requires some finesse. You only get a limited number, so choose wisely. I Focus on the essentials we’ve covered: Climatic Volume, Supply and Demand Zones, Support and Resistance, Fibonacci Retracement, ABC (Fibonacci Extention), Pivot Points, RSI, MACD and EMAs. These indicators give me a solid foundation without overwhelming the chart.

With only two indicators to be used at the same time on Tradingview, I need to plan my steps around these core indicators. I start with Climatic Volume, then I put on the Pivot Points along with the EMAs. Next, I start deleting what I already used and put on another indicator to study.

The beautiful thing about my method is that the Supply and Demand zones, Support and Resistance, and Fibonacci Retracement and Extension, are drawings and not indicators; therefore, they don’t take the indicator slots for me.

Lastly, keep an eye on the next post. I will talk in detail about how I use TradingView for free and will show the exact steps I use to apply my methodology while maintaining only two indicators working at the same time.

The Investor

Sunday 15 Septmeber 2024

About The Author

I started to look into individual stocks in January 2022. I created this diary initially for myself to track my investing progress, and second, as a place where I can share my ideas publicly hoping that others will share their ideas and learn from each other, and lastly as an online business where some links that I share are affiliate links, and if anybody bought anything by clicking those links, I will get a commission based on that successful sale, which of course will not affect the price that you are buying the product or service at.

For more detailed information on my affiliate disclosure please refer to the Full Affiliate Disclosure page, and if you are interested in building your own online business you can check this post here.

Furthermore, this site is in no way or form is giving any financial or investing advice, nor it is encouraging or discouraging people to buy or sell any financial instrument. This is a personal diary in which I track my own progress and share it for informational, educational, and entertainment purposes.

Thank you for sharing these valuable insights on optimizing trading strategies!

As someone who is focused on financial independence and lifelong learning, I’m always looking for ways to enhance my trading skills. I appreciate your breakdown of the five free TradingView indicators; they seem like great tools for minimizing risk and improving decision-making.

Do you have any tips for beginners on how to effectively integrate these indicators into a trading strategy?

Angela M. 🙂

Hello Angela, Thank you very much for your comment.

Regarding the tips for beginners on how to integrate these indicators into a trading strategy is going to be a gradual one through the coming articles.

Also, I am planning, for more clarity, to include videos that will show exactly how I am using these indicators. This process is going to be twofold; the first is through the continuous repetition of seeing me interacting with my trades using these indicators. The second is that I will write specific articles for each of the indicators which will finally lead to getting the step-by-step approach.

“Great post! I’m new to trading and haven’t used TradingView yet, but this definitely piqued my interest. The idea of using indicators to predict trends and spot opportunities sounds like something that could take time to master, but it seems like a skill worth developing. I appreciate the emphasis on patience and building your own methodology—it feels like it’s a long-term game rather than a quick win. Do you have any tips for beginners who are just starting to explore these indicators? Thanks again for sharing your insights!”

Hello Bayara, I am a beginner myself, this is why I am creating this diary. I am trying to document each step that I am taking just to show another beginner who is interested in trading how my journey is going.

In addition to that, I am going to explain each of the indicators one by one until I am able to show how I am using them all together. I am going to add another element to my articles which are videos that will show what I am talking about.

Thank you very much for bringing this question.

Hi there –

Trading is not everyone. Like most people I opt to play it safe and put money in mutual funds (among other saving vehicles) Though, there is something about actively working to make money or perfect a technique that is enticing.

The trading methodology mentioned in the article seems doable. Knowing or locating the volume Zone, where significant action took place is sound. It enables you to spot a similar pattern next time. Meanwhile, spotting stronger buyer and seller zones – will narrow down price movements.

With this information one can make a good decision about buying or selling. Though, there several other key identifiers mentioned in the article.

Overall, great guide for trading.

Hello Godwin,

Actually, I love the idea of mutual funds for investments.. unfortunately where I reside this option is not actively available.

If I had mutual funds available I would have opted for this instead of doing my own research and making my own investment decisions which of course would not be as sound as those of an investment fund with all the accumulated knowledge and experience they have.

This is on the investment part. For the trading part, I would have also preferred to find trusted people to manage my trading account, but I think I would both have a managed account and a self managed trading account. It will give me a gauge on my progress in learning skill.

Thank you very much for your comment.